How First-Time Homebuyers Can Maximize Their Advantage

Buying your first home is an exciting milestone - but it can also feel overwhelming when it comes to financing. Fortunately, Canadian homebuyers have two powerful tools at their disposal: the First Home Savings Account (FHSA) and the Home Buyers’ Plan (HBP). Understanding how these programs differ - and how they can work together - can help you unlock significant savings and boost your down payment.

How They Work Together

Here’s the good news: You can use both FHSA and HBP for the same home purchase. This combination can dramatically increase your buying power:

FHSA: Tax-deductible contributions and tax-free withdrawals for your first home.

HBP: Borrow from your RRSP without withholding tax, giving you extra liquidity.

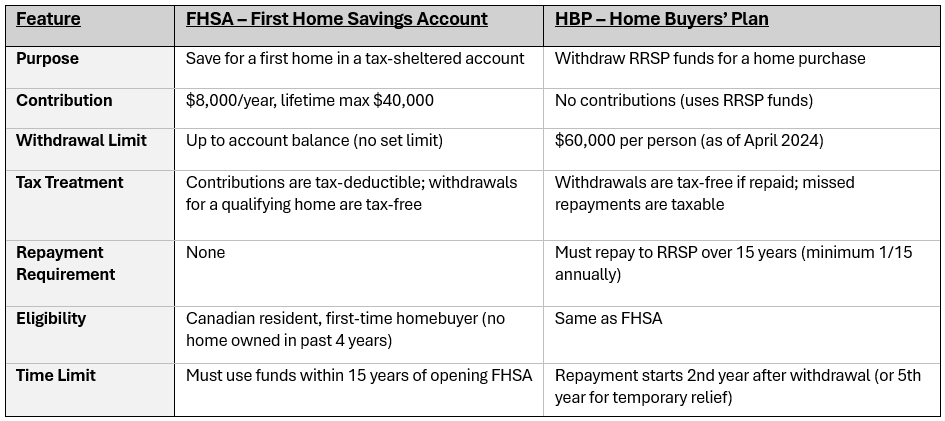

FHSA vs. HBP: Key Differences

FHSA + HBP: Combined Potential

Individual:

FHSA max: $40,000

HBP max: $60,000

Total: $100,000

Couple:

Two FHSAs: $80,000

Two HBPs: $120,000

Total: $200,000+ for a down payment

Strategy for Maximum Benefit

Start Early: Open an FHSA as soon as you’re eligible (age 18+) to maximize contribution room and growth.

Max Out FHSA First: Contributions reduce taxable income and grow tax-free.

Use RRSP for HBP: Contribute to your RRSP before withdrawal to boost your tax refund, then withdraw under HBP.

Coordinate Deadlines:

FHSA contributions deadline: December 31

RRSP contributions deadline: 60 days after year-end

Plan Repayments: Budget for HBP repayments to avoid tax penalties.

Combine with Other Incentives: Programs like the First-Time Home Buyer Incentive can still be used alongside FHSA and HBP.

Example Scenario

If you and your partner each:

Contribute $8,000/year to FHSA for 5 years → $40,000 each (plus growth)

Build RRSP savings and withdraw $60,000 each under HBP

You could have $200,000+ for your down payment - without triggering tax.

Bottom Line: By leveraging both FHSA and HBP strategically, first-time buyers can significantly increase their purchasing power and reduce tax burdens. Start planning early to make the most of these programs!

Parents and Grandparents - Listen Up!

Open a FHSA for your child as soon as they’re eligible (age 18+)!

The FHSA is a powerful way to jump‑start a future home purchase for your children. As soon as your child turns 18, they can open a First Home Savings Account - or you can open one in their name.

Once you open a First Home Savings Account, you begin generating annual contribution room of $8,000 per year (up to a $40,000 lifetime limit). If you have a child who has just turned 18, open up an FHSA under there name, so annual contribution room can accumulate! Any unused room carries forward, allowing your child to build significant tax‑advantaged space even in years you don’t contribute.

Because an FHSA cannot be opened before age 18, contribution room does not start accumulating until the year the account is opened.

Let’s Break it Down:

If your child turns 18 in 2027 and opens their FHSA that year, they’ll have $8,000 of contribution room for 2027.

If they contribute nothing in 2027 and in 2028, they will have $16,000 of unused contribution room which carries forward into 2029.

In 2029, they would have their new $8,000 limit for the year, plus $16,000 of carryforward = $24,000 total available to contribute that year (2029).

Even if your child is not planning on buying a house until their mid 20s - opening an account earlier allows for a huge savings advantage! By opening a FHSA as soon as they turn 18, accumulating contribution room and contributing strategically, young adults can maximize tax savings and accelerate their first‑home down payment.

Don’t wait – open an FHSA for your child as soon as possible!

If you know of someone who would benefit from this information - send them the link, so they can get ahead in planning for their future!

To learn more about First Home Savings Accounts (FHSA) check out the following link from Canada.ca: https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/first-home-savings-account.html